ASAS Newsletter - June 2022

"Post" Covid 19 ATO Crackdown

To all of us at ASAS Tax Accountants, we are aware that Covid 19 has had a major impacts on ourselves and our communities, and that we will continue to see its impact for some time to come.

We have noticed however that of late the Tax Office is starting to take a more aggressive stance in relation to recovery of monies owed and lodgement outstanding. Therefore we would recommend if you have any outstanding Tax Returns, Activity Statements or any monies owed to the Tax Office, we recommend that you contact us, so that the situation can be managed and penalties avoided.

Or if you suspect that may not be able to lodge all Tax forms, or make any payments on time, that you also contact our office, so that we can take action to avoid any ‘unpleasantries’.

Our Team, together with our trusted professional associates have the capacity, technical capability, and drive to support you over the next little while as we all get back on our feet. And we wish you all a better 2023 Tax Year.

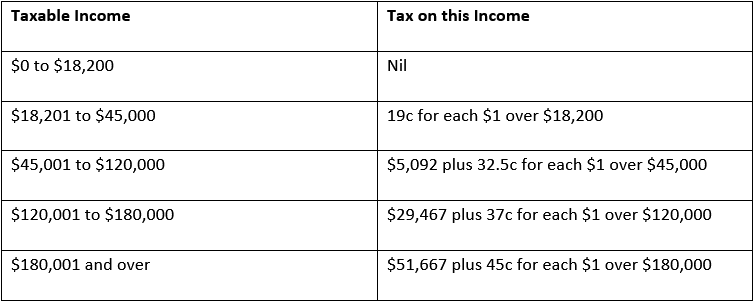

2022 Tax Rates

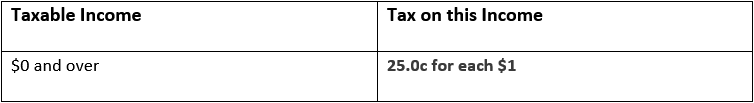

The Tax Rates for Individuals has remained unchanged from 2021, but the Tax Rate for Small Companies has moved from 27.5c to 25.0c, which is most welcome.

Individual Tax Rates (Residents)

Small Company Tax Rates

Tips for your 2022 Tax Return

The Tax Office produces Reports for each taxpayer and by late July or mid-August, which, while not always 100% correct/complete, will most likely provide most of the information from employers, banks, government agencies and other third parties, that we will need to complete individuals Tax Returns.

When you come to your appointment we will need to the following information, to confirm that the information provided by the Tax Office is correct and complete:

- Payment summaries,

- Bank Statements,

- Shares, Unit Trusts or Managed Fund Statements,

- Buy and Sells of Investments and Properties,

- Rental Property Statements,

- Details of foreign pensions and/or other foreign income.

Income

Here's the 5 most common types of income listed below. The Tax Office has substantial information, about the first two, some information about the third, but little if anything about the 4th and 5th. So, when you come to your interview with us, please be sure to bring as much information as you can about the 3rd, 4th & 5th types of income:

- Employment Income Super Pensions Annuities and Government Payments

- Investment Income (including interest, dividends, rent and capital gains)

- Foreign Income

- Business, Partnership and Trust Income

- Compensation and insurance payments.

Deductions

Most general deductions have a direct connection with the income you earned during the year.

To claim a deduction for work related expenses:

- you must have spent the money yourself and not reimbursed

- it must be directly related to earning your assessable income

- you should have a record to substantiate your claim

Here’s a general list of the things that you may be able to claim

- Vehicle and travel expenses.

- Clothing laundry and dry cleaning expenses.

- Gifts and donations.

- Home Office expenses: work related costs could include computer/smart devises, phone etc. and running costs such as power and/or Internet service.

- Dividend, Interest and other investment income deductions: examples include interest account fees, etc.

- Self education expenses: providing the study relates to your current job.

- Tools of trade, equipment and other equipment. If you buy tools or equipment to help you earn income you can claim a deduction for some or all of the cost.

- Other Items you can claim include union fees, the cost managing your tax affairs, income protection insurance, personal super contributions (depending on your circumstance you may be able to claim more than $27,500), travel to our office, and any other expense incurred in the course of earning your income.

Check with this office for more ideas. Sometimes one’s circumstances will define that you can and cannot claim as a deduction, so even if some above seem to fit your situation, please check with us first.

New – Director ID

It is now a requirement for all Company Directors to apply for a Directors ID.

The Online application can be found using the following link:

https://www.abrs.gov.au/director-identification-number

When this is done please email us details.

The process is well set out and you just walk through the steps and the Directors ID is issued at the end.

Employee Superannuation Changes

A couple of Changes form 1 July 2022:

- Employees who earn less than $450 per month are now eligible for Superannuation Guarantee,

- Superannuation is now payable if employee is under 18 so long as they work for 30 hours or more a week, and

- Super Guarantee rate goes up to 10.5%

Tax Records

Non Company Small Businesses and individuals now need only keep their Tax Invoices and other tax related documents for 2 years, while Companies and Large businesses need to keep their records for 5 years.

These types of records are no longer required to be kept in paper format. The Tax Office now recognises records kept in a variety of electronic formats.

Email Addresses/Contact Details

In line with our joint experience of the last couple of years or so, and the need for us to become more electronically connected you. So if you change your email address, phone number or any address, please let us know, so that we can get in contact with you if we need to get in touch with you for any reason.

Our preferred email address is info@allsas.com.au and we would encourage you, whenever possible to use this address with contacting us.

Business Activity Statements – Due Dates

The Tax Office has indicated to us that its business as usual and they have started to impose a penalties late lodgement. So it is important that we lodge Activity Statements etc. on time.

Set out below is a list of Business Activity Due Dates for the next 12 Months to help those whose who need to prepare and lodge.