New Office

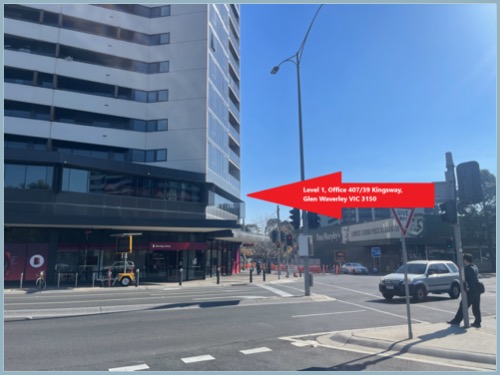

We have moved to a new location!

As of Monday, 16th June 2025, we are in our new office, 200 meters from our previous location.

The new address is Level 1, Office 407/39 Kingsway, Glen Waverley VIC 3150 (above the train station).

All existing emails and phone numbers remain as is. We look forward to welcoming you to our new premises and continuing to provide you with the same high level of service.

Who We Are

At ASAS Tax Accountants, we take pride in our ability to solve all Taxation, Financial and Business related queries for all types of clients, from individuals to companies with a combined experience of more than seventy five years in the industry. We give great preference to customer satisfaction as well as our ability to provide immediate and efficient response to all client queries.

What Do We Do?

We are accountants and tax consultants, specialising in tax returns, companies, business activity statements and much more!

We are pleased to offer a wide range of professional services.

Our qualified and highly experienced team can help you with your personal and business accounting needs.

LOOKING FOR FINANCE?

If any of the following apply to you, why not let us assist. You will be dealing with an accountant and registered tax agent who can recommend on tax effective finance.

BUSINESS CONSULTING

If you are contemplating buying a business or starting a new business, talk to the experts first. Let us independently assess and recommend any business you are considering.

FINANCE LENDERS

Our lenders comprise conventional banks along with a number of non conforming funders. Consultations can be arranged at your home after hours with no fee charged by us *

* Lenders & government fees & charges may apply.